how much tax is taken out of my paycheck new jersey

Taxpayers can choose either itemized deductions or the standard deduction but usually choose whichever results in a higher deduction and therefore lower tax payable. Switch to New Jersey hourly calculator.

What To Do When Employee Withholding Is Incorrect Cpa Practice Advisor

Your average tax rate is 222 and your marginal tax rate is 361.

. You Should Never Say I Cant Afford That. What is the NJ tax rate for 2020. 6 rows New Jersey income tax rate ranges from 140 to 1075 and there are also three types of.

Post-Retirement Contributions to a Section 403 b Plan. Get A Jumpstart On Your Taxes. NJ Taxation Effective January 1 2020 the tax rate on that income bracket increases from 897 to 1075 regardless of filing status.

This marginal tax rate means that your immediate additional income will be taxed at this rate. Get Your Max Refund Today. Employer Requirement to Notify Employees of Earned Income Tax Credit.

The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for New Jersey residents only. Medicare and Social Security taxes together make up FICA taxes. Unemployment compensation received from the State of New Jersey as well as the additional 600 per week provided as part of the CARES Act is not taxable on your New Jersey tax return.

New Jersey has a progressive income tax policy with rates that go all the way up to 1075 for gross income over 5 million. Your employer will withhold 145 of your wages for Medicare taxes each pay period and 62 in Social Security taxes. What money gets taken out of my paycheck.

New Jersey Salary Paycheck Calculator. FICA taxes consist of Social Security and Medicare taxes. The payroll taxes taken from your paycheck include Social Security and Medicare taxes also called FICA.

How Your New Jersey Paycheck Works. The New Jersey Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and New Jersey State Income Tax Rates and Thresholds in 2022. New Jersey Health Insurance Mandate.

I live in New Jersey. Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay. Generally around 15 is taken out of each paycheck and held for taxes social.

New Jersey requires employers to withhold state income and applicable local income taxes from employee paychecks in addition to employer paid state unemployment taxesFor New Jerseys tax rates click here. For 2021 employees will pay 62 in Social Security on the first 142800 of wages. Calculates Federal FICA Medicare and withholding taxes for all 50 states.

Tax brackets vary based on filing status and income. Calculate your New Jersey net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free New Jersey paycheck calculator. File and Pay Employer Payroll Taxes Including 1099 1095 Electronic Filing Mandate.

For instance an increase of 100 in your salary will be taxed 3613 hence your net pay will only increase by 6387. New Jersey State Payroll Taxes. Your New Jersey employer is responsible for withholding FICA taxes and federal income taxes from your paychecks.

First your paycheck with your take home pay net pay after all deductions that you have in your hand will not have anything withheld from it because it is issued to you after all of the necessary. The standard deduction dollar amount is 12550 for single households and 25100 for married couples filing jointly for the tax year 2021. Amount taken out of an average biweekly paycheck.

The Paycheck Calculator may not account for every tax or fee that applies to you or your employer at any time. Everything You Need To Know About Taxes This Year Rich Dad Poor Dad Author Robert Kiyosaki. The percentage that is taken out of your paycheck depends on your exemptions and the amount of money you make.

10 rows To use our New Jersey Salary Tax Calculator all you have to do is enter the necessary details. This New Jersey bonus pay aggregate calculator uses your last paycheck amount to determine and apply the correct withholding rates to special wage payments such as bonuses. I live in - Answered by a verified Tax Professional.

W4 Employee Withholding Certificate The IRS has changed the withholding rules effective January 2020. FICA taxes are commonly called the payroll tax however they dont include all taxes related to payroll. Employees may fill out Form NJ-W4 to be used instead of the federal W-4.

Where Do Americans Get Their Financial Advice. Import Your Tax Forms And File For Your Max Refund Today. Details of the personal income tax rates used in the 2022 New Jersey State Calculator are published below the.

These amounts are paid by both employees and employers. Commuter Transportation Benefit Limits. Ad Free For Simple Tax Returns Only With TurboTax Free Edition.

New Jersey State Payroll Taxes What are my state payroll tax obligations. What can I do to reduce the amount of taxes taken out of my paycheck every pay period. It is not a substitute for the advice of an accountant or other tax professional.

A 2020 or later W4 is required for all new employees. We use cookies to give you the best possible experience on our website. The tax rate on wages over 1000000 and up to 5000000 for the State of New Jersey has changed from 213 percent to 118 percent for all tax tables.

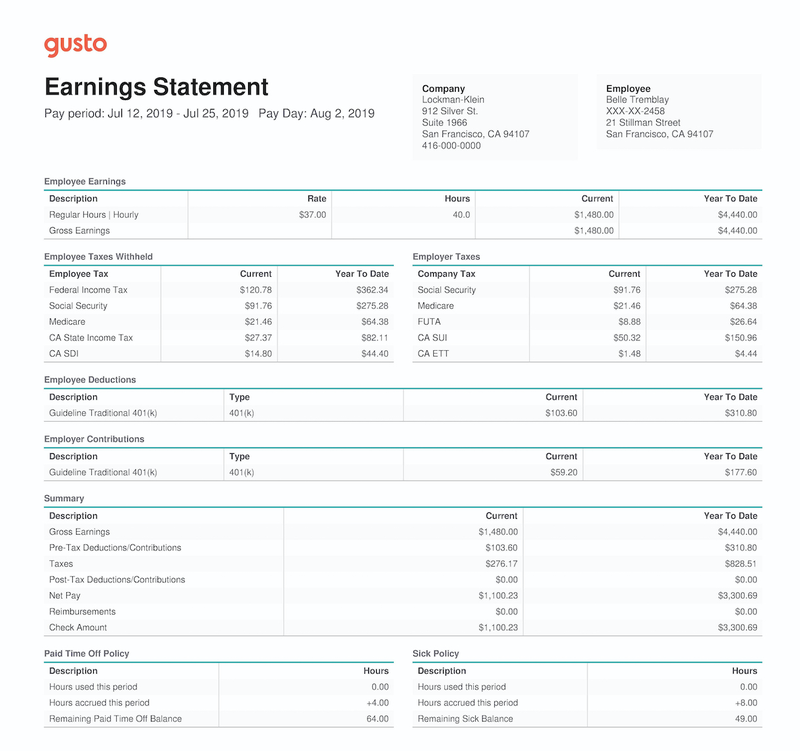

Pay Stub Meaning What It Is And What To Include On A Pay Stub

Here S How Much Money You Take Home From A 75 000 Salary

25 Great Pay Stub Paycheck Stub Templates Excel Templates Templates Salary

Sample Pay Check And Fica Taxes Savings For Cpt Opt Studetns

Gross Wages What Is It And How Do You Calculate It The Blueprint

Paycheck Calculator Take Home Pay Calculator

Is It Possible For A Weekly Salary Of 500 To Have Over 100 Of Taxes Taken From Each Paycheck Quora

I Make 1 200 Biweekly How Much Do I Take Home After Taxes Quora

Pin En Personal Financial Literacy For Ells

Paycheck Calculator Take Home Pay Calculator

New Jersey Nj Tax Rate H R Block

I Make 800 A Week How Much Will That Be After Taxes Quora

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

Free Online Paycheck Calculator Calculate Take Home Pay 2022

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

2021 New Jersey Payroll Tax Rates Abacus Payroll

How To Read Your Paycheck Stub Clearpoint Credit Counseling Cccs Credit Counseling Independent Contractor Payroll Template

Get Our Image Of Quit Claim For Final Pay Template For Free Quites Mississippi Templates